Announcing Matrix XII: An $800M fund to invest from concept to Series A Read more

2022 was a tough year for the market overall and especially for high growth companies. The market faced significant headwinds in practically everything: inflation, rising interest rates, geopolitical uncertainty in Ukraine and China, and post-COVID mean reversion.

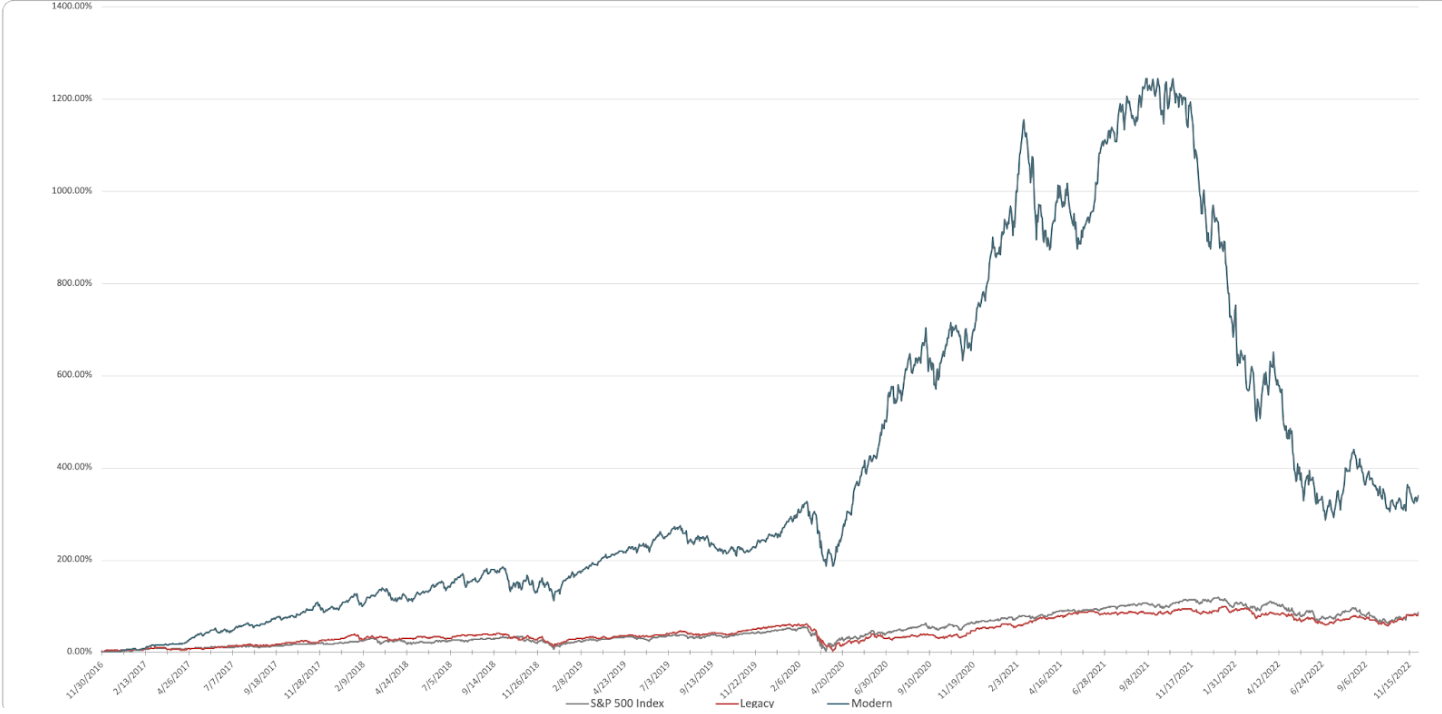

Nearly all indexes were down in 2022 and the Fintech Index was no exception. The Fintech Index’s 61.57% decline dwarfed the 2.84% decline in legacy financial institutions and the 10.66% decline in the S&P 500.

However, since its inception in 2016, the Fintech Index still significantly outperformed both the S&P 500 and legacy financial institutions, representing a 338.88% gain compared to 81.02% for legacies and 85.56% for the S&P 500.

We believe the Matrix Fintech Index will continue to outperform in the long run. Smart investors will do well by betting on innovation and consumer experience in one of the world’s largest and most antiquated industries: financial services.

Fintech is a nascent category, especially in the public markets. In the Matrix Fintech Index, modern fintech companies represent $378 billion in market cap compared to the incumbents’ $4.2 trillion. In a broader survey published by Coatue, legacy financial services represent up to 45x the market cap of fintechs (~$300 billion versus $11.1 trillion). However you count it, this discrepancy hints at the opportunities ahead for fintechs.

Bezos famously said his competitors’ margins were his opportunity. Smart fintechs see an opportunity in the market cap of these inefficient, inaccessible, opaque, and consumer-unfriendly companies. And they see that there’s $11 trillion of that opportunity up for grabs.

The Matrix Fintech Index is composed of companies that went public in the last decade and span subsectors including payments, insurance, lending, and consumer financial services. This year we broke performance down by sub-sector, which highlighted noticeable differences in performance within sectors (e.g. modern payments vs. legacy payments) and across sectors (modern payments vs. modern lending).

Just like the overall Fintech Index, nearly every modern subsector saw a greater relative one-year decline than every legacy subsector. For example, modern lending declined 85.74% while legacy lending declined only 19.71%. Modern payments declined 57.77% while legacy payments actually grew 3.28%.

However, in the long run, nearly every modern subsector significantly outperformed every legacy subsector – even after accounting for 2022’s declines. In some subsectors the outperformance was significant, such as modern lending’s 834% growth versus legacy lending’s 117% growth. The only modern subsector that underperformed its legacy counterpart was real estate and proptech, with the modern cohort returning 88% versus the legacy’s 195%.

All asset classes took a beating in 2022, but high-growth categories and companies – like those in the Matrix Fintech Index – faced the steepest declines.

Such volatility makes for good headlines, but obscures the long-term trend in an area like financial services, which is in the middle of significant disruption. “Software eating the world” is almost a cliche by now. However, the $11 trillion difference in market cap between modern and legacy financial institutions emphasizes how much more there is for these fintechs to eat.

This doesn’t mean that every modern fintech subsector will continue to outperform its legacy benchmark, especially in the short term. For example, rising interest rates are a headwind for subsectors with exposure to capital markets, like lending and real estate. Modern fintechs in these sectors may be disproportionately affected, as they are at a smaller scale and have a less robust capital markets function compared to their legacy counterparts.

So it won’t be a smooth path as the modern fintechs eat the market share and caps of their legacy competitors. However, the Matrix Fintech Index has substantially outperformed legacy financial institutions for the 7 years during which it’s been published. This strong performance suggests that fintech is here to stay and has a lot more room to grow for long-term investors.